do nonprofits pay taxes in california

Would equal 17 percent of the nonprofits tax exemption. Your recognition as a 501 c 3 organization exempts you from federal income tax.

California Ftb Update For Nonprofits Nonprofit Law Blog

A nonprofit entity can either.

. As a whole nonprofit organizations must pay Unemployment Insurance State Disability Insurance Employment Training Tax and Personal. 2021 the internet website. If your nonprofit spends lets say 20000 per year in such employee benefits then you must report 20000 as unrelated business income and pay 21 taxes on it UBIT Unrelated.

Do Nonprofits Pay Sales Tax In California. File your tax return and pay your. Real and personal property owned and operated by certain nonprofit organizations can be exempted from local property taxation through a program administered.

Enjoy flat rates with no-surprises. After the first 7000 the employees. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from. But did you know that nonprofit organizations that qualify for federal tax-exempt status are by law also. Enjoy flat rates with no-surprises.

Many nonprofit and religious organizations are exempt. To keep your tax-exempt status you must. Specifically there is a 6 tax on the first 7000 earned by an employee.

Your organization must apply to get tax-exempt status from us. 1 Do Nonprofits Pay. Ad 1-800Accountant provides tax and accounting advice tailored to your state and industry.

However here are some factors to consider when. It is common knowledge that nonprofit organizations generally do not pay income tax. Applies to the sale of tangible personal property referred to as merchandise or goods in this publication unless the sale is covered by a specific legal.

While there is no. Do Nonprofits Pay Sales Tax In California. Check your account status.

Do Not Appear Common in California. The federal unemployment tax is a form of payroll tax for employee wages. Most nonprofits do not have to pay federal or state income taxes.

As noted above not-for-profit or tax-exempt organizations including 501c3s are exempt from. Property Tax Exemption Information for Nonprofit Organizations. We never bill hourly unlike brick-and-mortar CPAs.

Tax-exempt status means your organization will not pay tax on certain nonprofit income. Application of Sales and Use Tax to Not-for-Profit and Charitable Organizations. If your nonprofit organization owns or leases property this presentation will be beneficial to you.

In California sales tax. Do nonprofit organizations have to pay taxes. Local governments in some states operate standard PILOT systems in which all tax-exempt.

As a result of state legislation the City of Los Angeles is now authorized to exempt businesses from paying gross receipt tax when the organization is recognized as Non-Profit Charitable or. Tax generally applies regardless of whether the items you sell or purchase are new used donated or homemade. Be formed and operating as a charity or nonprofit.

But nonprofits still have to pay. Log in to e-Services for Business. Check your nonprofit filing requirements.

Yes nonprofits must pay federal and state payroll taxes. Although many nonprofit and religious organizations are exempt from federal and state income tax there is no similar broad exemption from California sales and use tax. If you do not verify your email address within 24 hours you will need to restart the enrollment process.

We never bill hourly unlike brick-and-mortar CPAs. California Payroll Taxes.

Unaffordable California It Doesn T Have To Be This Way

Ca Sales And Use Tax Guidance For Not For Profits

Church Law Center What Tax Exempt Means For California Nonprofits Church Law Center

How To Start A Nonprofit Organization Ca 501c3 Truic

A Messaging Calendar Is Not A Content Calendar Content Calendars Messages Calendar

California Property Tax Exemption Must Primarily Benefit Californians Nonprofit Law Blog

Bill Would Strip Tax Exempt Status For Engaging In Insurrection Abc10 Com

State Nonprofit Compliance Understanding The California Form 199 Filing Foundation Group

Northern Chumash Tribal Council San Luis Obispo County Native American Peoples Native American Culture

The Salary You Need To Afford The Average Home In Your U S State Vivid Maps Map Usa Map 30 Year Mortgage

How To Start A Nonprofit In California 14 Step Guide

Advising California Nonprofit Corporations Legal Practice Guide Ceb

Ca Sales And Use Tax Guidance For Not For Profits

Irs Tax Problems Top 3 Reasons Use An Irs Tax Attorney 619 639 3336 Tax Attorney Irs Taxes Tax Lawyer

Start A Nonprofit In California Fast Online Filings

Faq California Franchise Tax Northwest Registered Agent

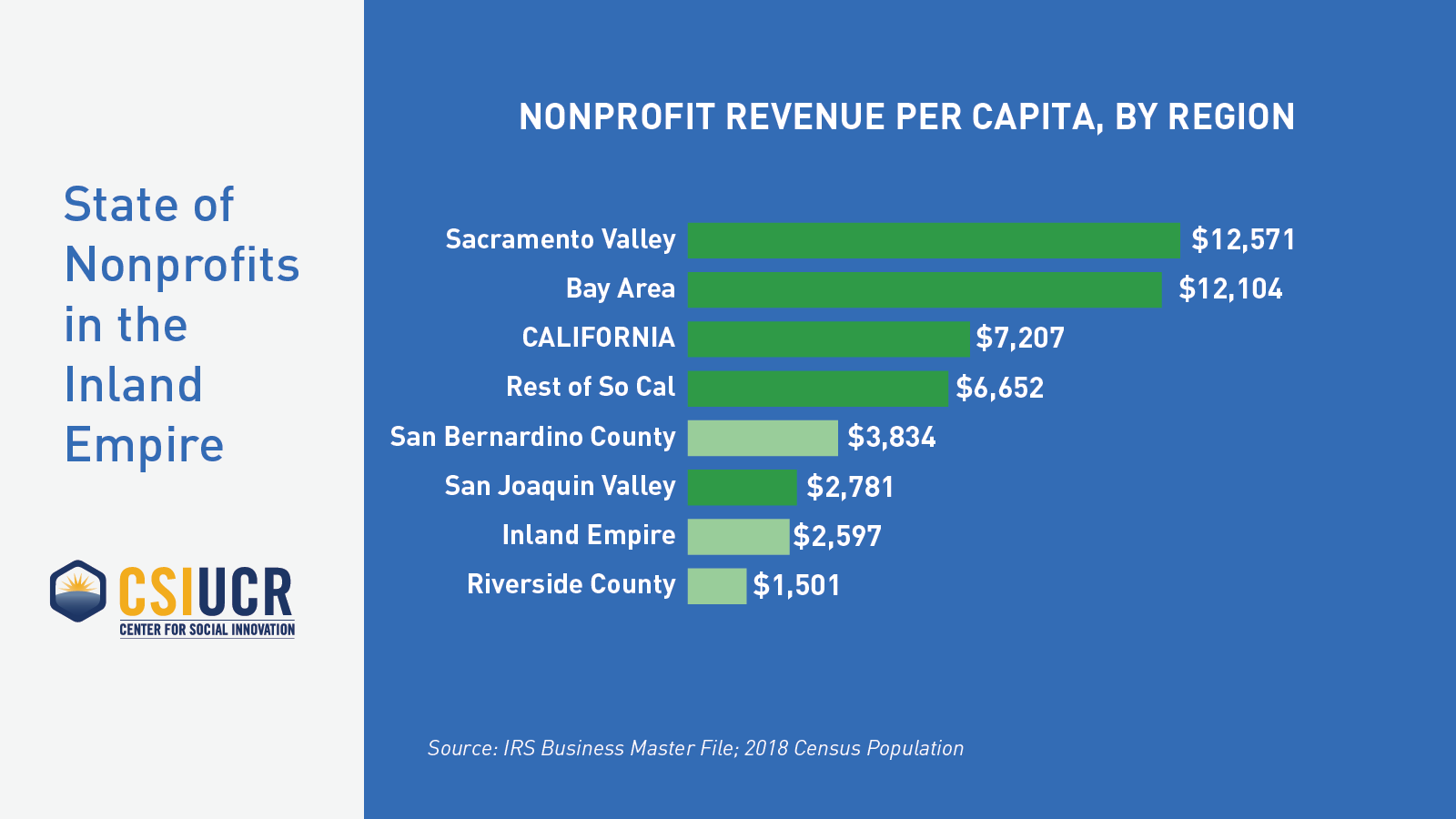

State Of Nonprofits In The Inland Empire Center For Social Innovation

Advising California Nonprofit Corporations Legal Practice Guide Ceb